Mail theft and check fraud are serious issues plaguing individuals and businesses alike. Small businesses are attractive targets for criminals, as they often lack the resources to protect themselves from this type of crime. Fortunately, there are a variety of techniques and technologies that can be used to help prevent check fraud and mail theft.

With advancements in technology and the rise of online banking, criminals have found new ways to exploit vulnerabilities and steal sensitive information. In this article, we will explore the dangers of mail theft and how technology can prevent check fraud, ensuring the security of your financial transactions.

Table of Contents

Mail Theft and Check Fraud USPS

According to a recent United States Postal Service (USPS) warning, mail theft, and check fraud are two of the most common forms of financial fraud. Criminals use stolen checks to access accounts, withdraw funds, and make purchases. They may also steal mail containing personal information, such as bank account numbers or Social Security numbers, which they can use to open accounts and make fraudulent transactions. The post office has attributed this concerning trend to various factors, including mail theft-related check-fraud schemes and the ability of scammers to wash checks.

This surge in fraudulent activities has significantly impacted both individuals and small businesses. Victims of check fraud may find their bank accounts drained, lines of credit maxed out, or even face identity theft. On the other hand, small businesses suffer financial loss and reputational damage, making it harder for them to operate efficiently.

Mail Theft and Check Fraud Are Huge Issues

Mail theft and check fraud criminals affect both individuals and businesses. Statistics show a concerning increase in bogus checks reported by banks, indicating the widespread nature of this criminal activity. Additionally, there has been a surge in complaints of mail theft, which often leads to check fraud.

One factor that sent reports of check fraud through the roof was the distribution of government relief checks during the COVID-19 pandemic. Criminals took advantage of these payments’ chaos and confusion to exploit vulnerable individuals and businesses. This resulted in a sharp rise in fraudulent checks being deposited and cashed.

Business checks are particularly vulnerable to fraud due to the higher amounts involved, and businesses often have well-funded accounts. Moreover, postal service employees can pose a risk as they can access mailed checks, making them potential targets for theft.

How Do Criminals Cash Fake Checks?

Criminals have become increasingly sophisticated in their methods of cashing fake checks. The primary way that criminals cash fake checks is by check washing and manipulating them. This involves using chemicals, like nail polish remover, to remove the original information on a check, such as a payee’s name, and replacing it with new details. They can then deposit the money into a fake business account or cash the check at a bank or retailer while using a fake identity to avoid being caught.

Another way scammers carry out check fraud is through identity theft. In this crime, criminals steal personal information, such as Social Security numbers, to access someone’s bank accounts. They then use the stolen data to create fake checks using the victim’s credentials and cash them at a bank or retailer.

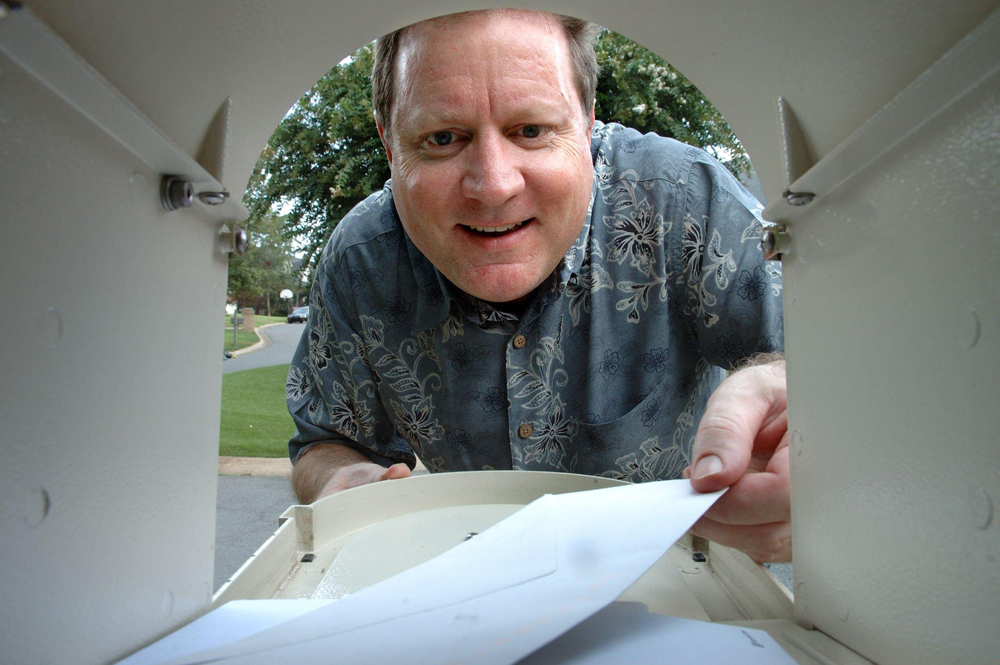

Criminals may also try to gain access to mailboxes or postal carriers to steal genuine checks before they are delivered. They can then alter or sell these checks on the dark web or even create fake checks in a victim’s name and deposit them into their accounts.

Speaking of altering, did you know that washing checks are the most common type of check fraud?

Washed checks involve altering legitimate checks by removing or modifying the original details. Criminals use chemicals to erase the ink on the checks giving them new blank checks. This allows them to change the payee information or the amount of money written. After the alteration, they deposit the counterfeit checks into their accounts, effectively stealing the funds.

Another method used in check fraud is the theft of checks from mailboxes and blue collection boxes. Criminals target residential mailboxes or collection boxes to steal outgoing mail. Once in possession of the stolen checks, they can alter them or create new ones impersonating the rightful owner.

Check fraud is an alarming issue that affects countless individuals and organizations. It is essential to be aware of the signs of fraud and take precautions to protect oneself from becoming a victim. Now let’s take a look at how to combat check fraud.

Technology to the Rescue!

Technology can be an invaluable tool in helping businesses protect themselves against mail theft and check fraud. Businesses can implement measures such as scanning or digitally storing checks, using electronic signatures for signing documents, and investing in artificial intelligence software to detect suspicious activity.

Modernizing payment methods can provide a safer alternative to traditional paper checks, reducing the risk for individuals and businesses.

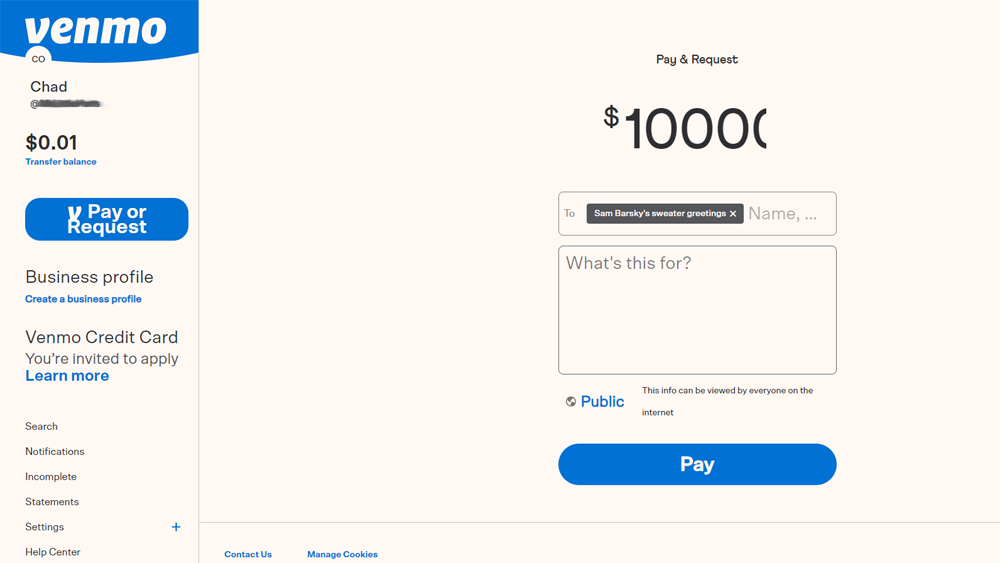

One solution is exploring online payment systems such as ACH, Zelle, Venmo, Cash App, and Quickbooks Online Payment processing. These options offer convenience, efficiency, and, most importantly, enhanced security against check fraud.

By utilizing online payment solutions, small businesses can reduce their reliance on paper checks, eliminating the need for physical checks to be mailed or dropped off at collection boxes. This significantly reduces the opportunities for criminals to intercept and manipulate checks, safeguarding against mail theft-related check fraud.

Online payment systems utilize encrypted transactions and robust security measures, making it extremely difficult for fraudsters to forge or alter payment details. Furthermore, these platforms often require authentication measures such as biometric data or two-factor authentication, adding an extra layer of protection.

Modernizing payment methods with online solutions mitigates the risk of check fraud, enhances efficiency, and simplifies the payment process for businesses and consumers. By embracing these alternatives, we can make significant strides in combating check fraud and ensuring the security of financial transactions.

Businesses can also use secure mail drop services to ensure that their mailed documents are not intercepted or stolen. These services provide secure mailboxes with a tracking system that allows businesses to monitor and track the delivery of their documents. You don’t have to worry about mail carriers failing to deliver your documents or your mail getting lost in transit. Furthermore, secure mail drops help protect sensitive information by providing secure storage and transport of documents.

Wrapping Up

Mail theft and check fraud can devastate individuals and businesses. However, with advancements in technology, there are now more effective ways to protect yourself and prevent these crimes from occurring.

You can significantly reduce the risk of mail theft and check fraud by utilizing tools such as secure mailboxes, electronic payments, and check verification systems. It is important to stay informed and proactive in implementing these measures to safeguard your personal and financial information. Remember always to check your bank account statements, and if you see any suspicious transactions, report them immediately.

Mailing checks and receiving checks by mail should be a thing of the past. By utilizing more secure payment systems, businesses can mitigate the risk of check fraud and stay ahead of criminals looking to exploit outdated mail security measures.

Contact your financial institution or message us for more information on protecting yourself from mail theft and check fraud.

Recent Comments